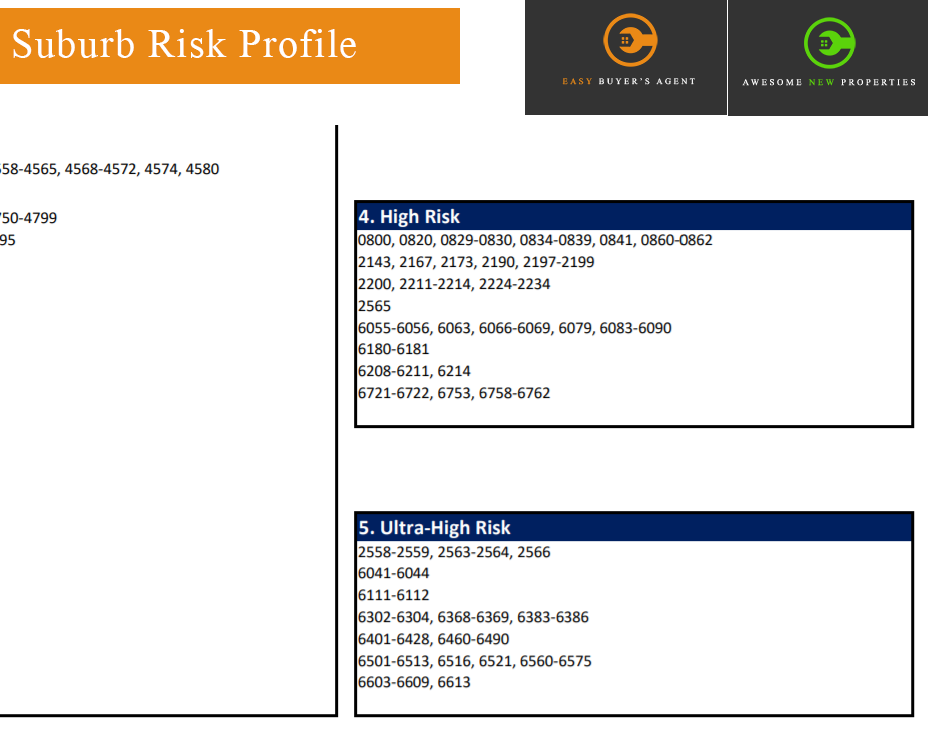

Bank’s Internal Suburb Risk Profile Assessment

Bank’s Internal Suburb Risk Profile Assessment ?? DO YOU KNOW that every #bank has their internal #suburb risk profile assessment? And based on this information, they might approve/deny your purchase especially if majority of your #portfolio is geared towards the high risk suburbs. Banks themselves might have been very exposed by giving out mortgage in these high risk suburbs at the height … Bank’s Internal Suburb Risk Profile Assessment