High Yield vs High Growth? Or Can We Hybrid?

As a Buyer’s Agent I am often asked this question: “Why would you buy a high yield property that is positive cashflow since this type of properties are generally not in the high growth area? Isn’t it better to buy in a high growth area, which the growth alone will eclipse any cashflow?”. You personally, yes I’m talking to you my beloved reader. What would you do? Which property would you buy?

If you ask me, I would first define high growth property. Does “high growth” mean a property that can give you quick profit? Or is it a property that keeps growing at a good pace long term? See, in my opinion we need to split the two definition. If you want to buy a property that can give you quick profit, then I wouldn’t regard that as a “high growth” per-se because quick profit can be crafted through value-add flipping exercise such as renovation, or subdivide-build-for-profit. An example was this 4×1 property below that I purchased for $415k for my client in a medium-up suburb. My client then spent around $130k renovation, adding a bathroom to make it 4×2, and 7 months (after initial purchase settlement date) later, the property has now been sold for $670k. It’s some $80k+ profit in 7 months, ROI of invested cash was around 34% in 7 months. That’s pretty good compared to bank’s cash interest of 2%/12 months.

Case study for the property above is below. These are the projected numbers I presented to my Buyer when we first were investigating prior to purchase:

https://easybuyer.com.au/portfolio/renovators-delight-renovation-and-flip

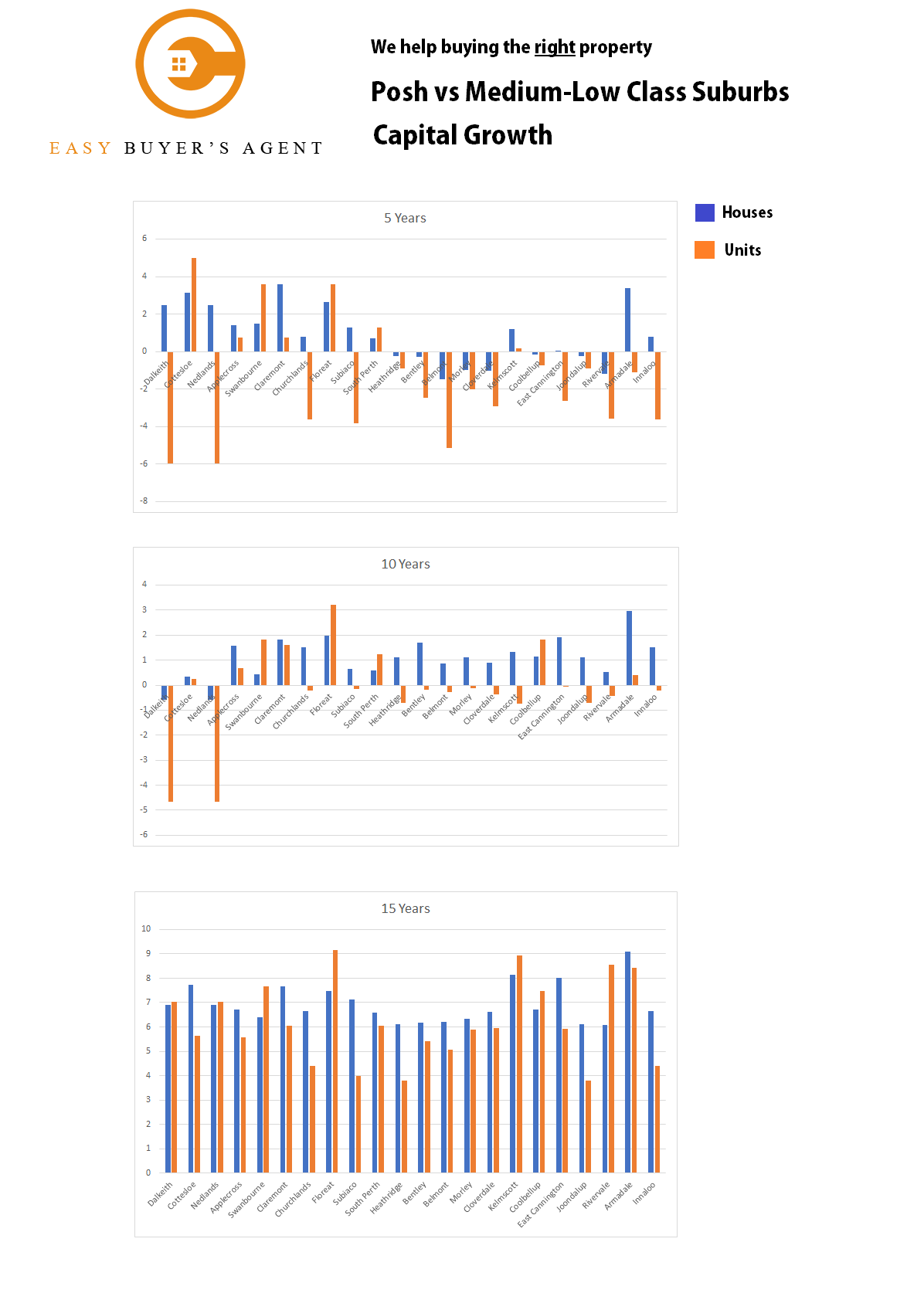

What about the long term growth one then? I have done my research by analysing some 20+ suburbs price growth from 1990. Below is the result:

If you are not familiar with WA, the suburbs from the left up to South Perth are posh/blue-chip/A-grade, the rest are medium-low.

As you can see, 15 years+, there is no proof that A-Grades grow more than the B-Grades. So, what does that tell me? It tells me that if it is for a long-term hold, I would not hesitant buying a B-Grade high yielding property. Just imagine a $1mil property that is rented for only $600/week (3.12% gross yield, highly negative cashflow) VS a $148k property that is rented for $240/week (8.4% gross yield, positive gearing). To hold a $1mil negative-cashflow property is difficult unless you have low LVR. If you borrow 80-90% then it will become difficult for your pocket. All it takes is just for you to lose your job, or your rental income being reduced (e.g. because of COVID), and it will create a huge financial strain.

The $148k property on other hand is very easy to maintain. It’s cheap and it can pay for itself. Long term, this $148k property might also grow as much, if not more than the $1mil counterpart. (By the way, this $148k is a real client’s case study. Have a look here https://easybuyer.com.au/portfolio/buy-hold-8-yield).

Conclusion

If you want to “trade” property e.g. buy-sell for a quick profit, then you don’t have to look in the “high growth” suburbs. Instead, look for value-add potential property. If you’re looking to hold long term, I personally will go for a high yielding property because not only will they grow at the same rate, they are cheap to hold.

If I have $1mil to play around, I would rather buy 5 x $200k or (1 x $500k + 3 x $160k) instead of 1 x $1mil or 2 x $500k for that matter. Basically, if the cashlow is way too negative, I would not bother. It’s too stressful. With the high yield positive cashflow property, you might also be able to keep borrowing to buy more because you are actually earning money.