Profiting From Meth-House

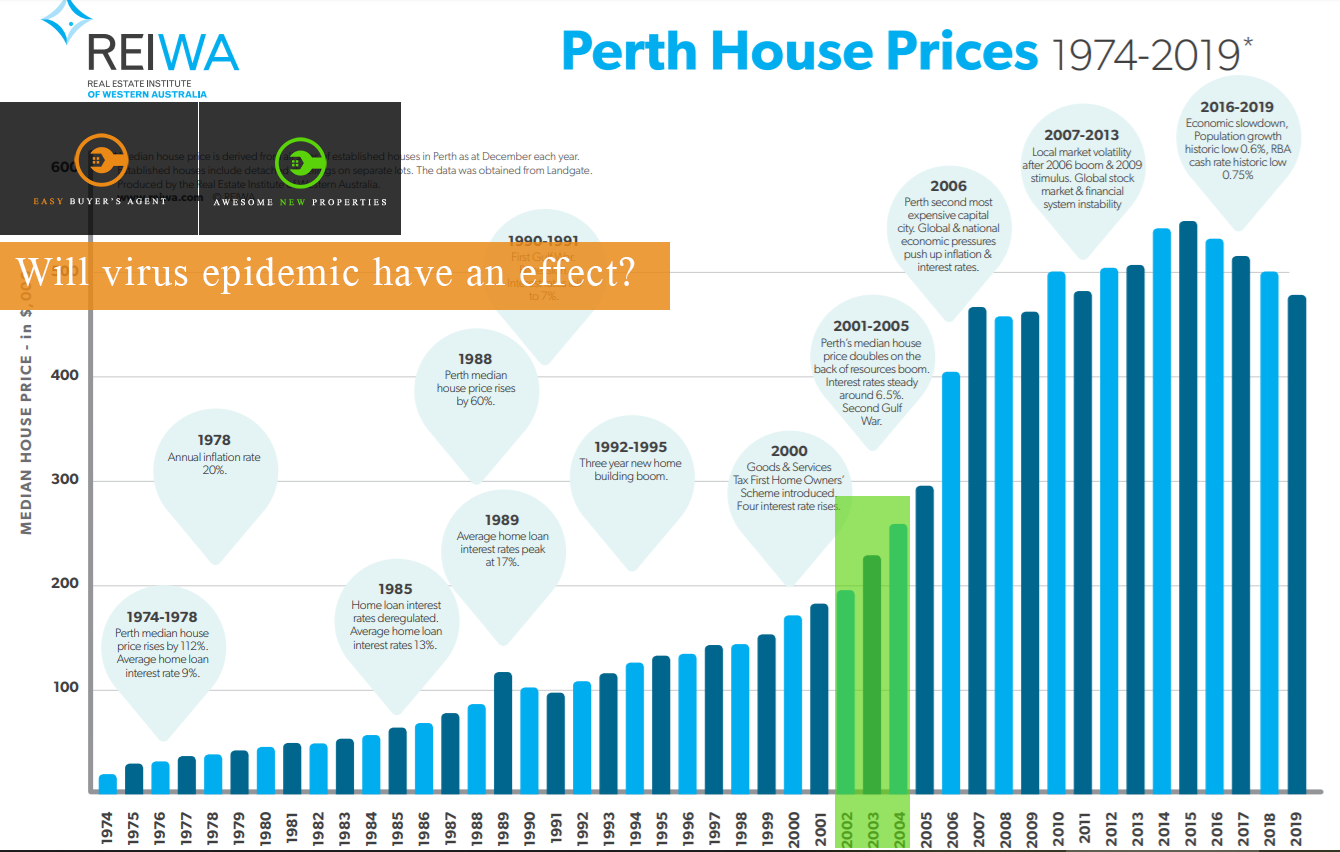

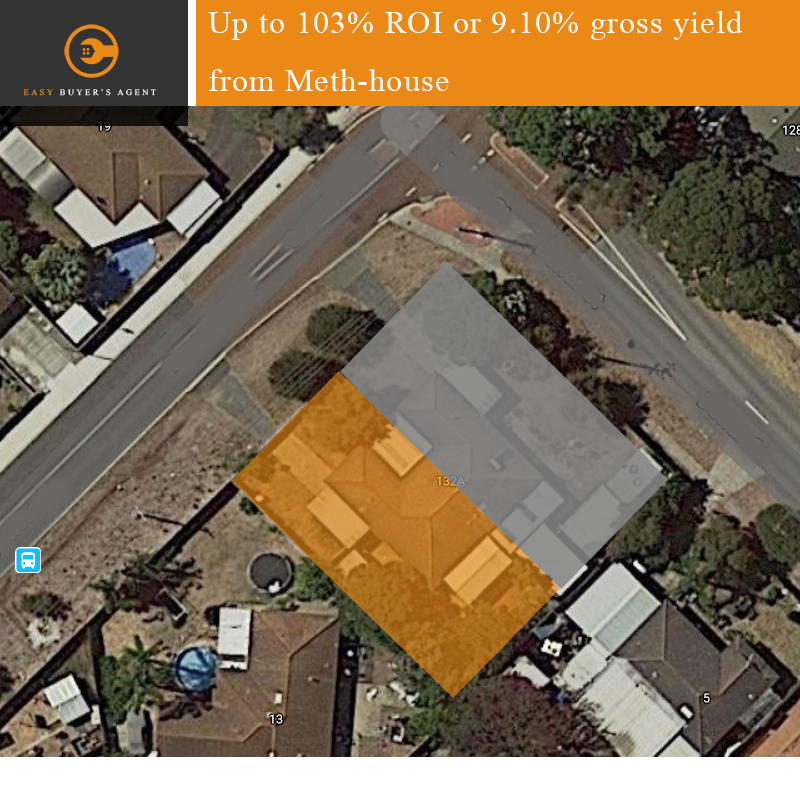

Profiting From Meth-House ?? PROFITING FROM METH-HOUSE. Have you ever considered buying a meth-house? Basically it is a house that is contaminated by meth. While this might not be everyone’s cup of tea, but the potential is excellent. I just purchased a 3×1 duplex that was meth contaminated. Asking price was originally $125k, I negotiated down … Profiting From Meth-House