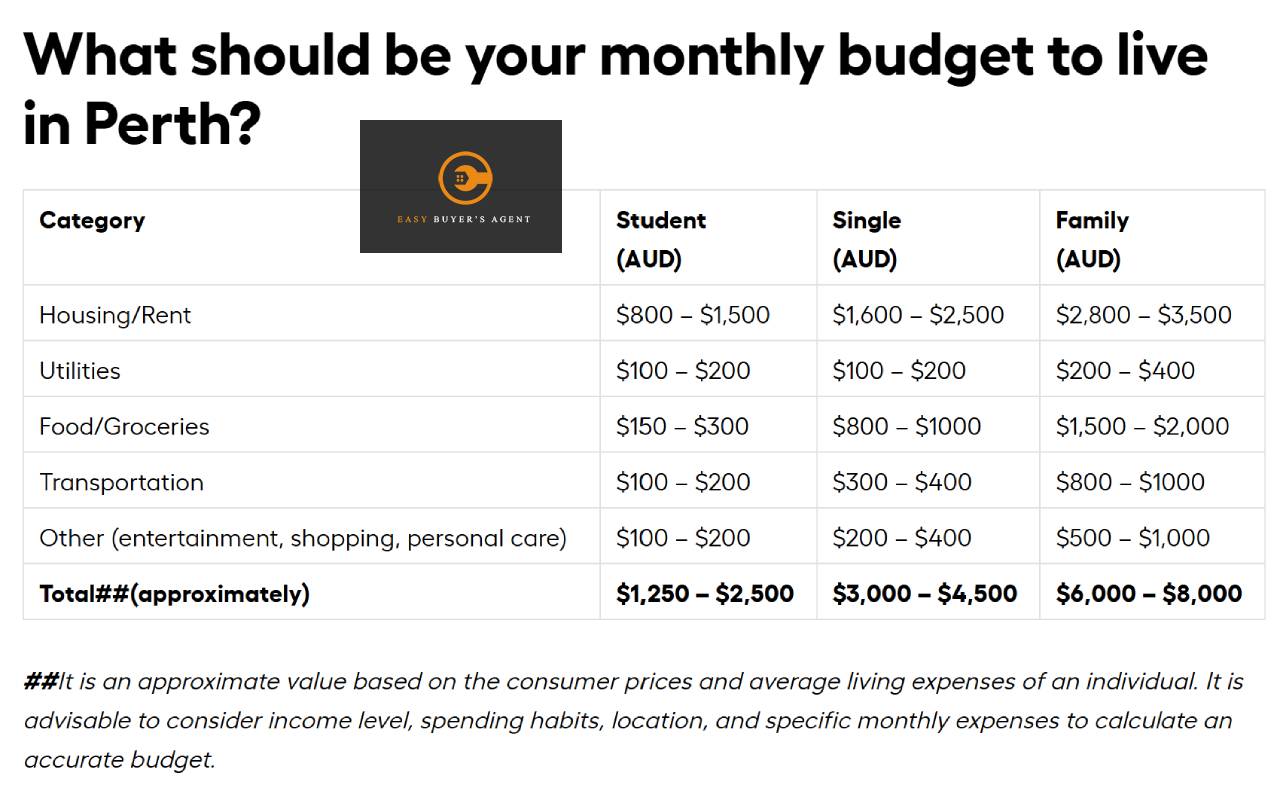

Can You Afford Buying Property on Average Salary?

PERTH’S LIVING MONTHLY BUDGET. Can you afford buying a #property using average #Salary? The average salary here in Perth as a single person is about $85,000 which brings in (according to PayCalculator) about $5579/month net. #buyersagent Based on the the table below, even if you are on the highest percentile expense-wise as a single adult, … Can You Afford Buying Property on Average Salary?