Low-Socio Suburbs Have No Capital Gain They Say?

???? A lot of Property Buyers are focusing so much on capital growth. And they should. Because of this however, a lot of Buyers are often only considering the “A-Grade” suburbs. How many times have I heard, throughout my career as a Buyer’s Agent, people say things like, “Which suburbs should I buy in that would have the highest growth?”, or, “Oh I wouldn’t want to buy in those bad suburbs…there is no growth”.

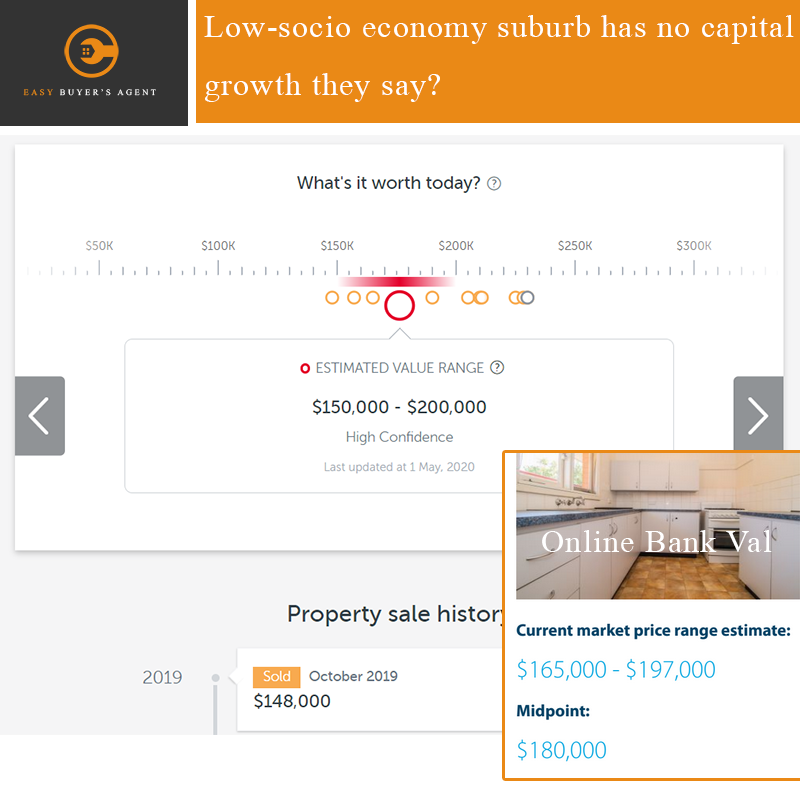

You know what, below is one of the properties we purchased for one of our clients 7 months ago, October 2019. A 4×1 green-title property located in low-socio economy area (a suburb which many property buyers would not even consider) with purchase price of $148,000. As of today, high-confidence valuation from CoreLogic RPData says, it’s valued between $150-$200k. Let’s take less-than-middle-ground point at $160k. A $12k increase. (If you see in the image, online bank valuation actually indicates a $180k price estimate ie. $32k increase). But, let’s work with $12k convervatively.

If my buyer was putting in 10% deposit + 5% purchase costs (let’s say $20k all up), a $12k increase = 60% ROI. If I put that $20k in the bank, as of 2020, I will only get less than 1%/annum! And here we are, this Investor Buyer has just potentially made at least 60% ROI in 7 months*.

This is why I’m not too bothered with suburb selection. As long as you buy right, a property that has value-add potential, below market price purchase, there will be a good opportunity for capital growth.

PS: This property is currently rented at $240/week = 8.4% gross yield positive gearing. Sometimes I wonder, why did I present this property to him and not buying it myself?

My buyer would just hold onto this and wait until market is rising, and imagine how much ROI he is making in the rising market. With positive gearing, it shall not cost him a dime to hold.

If you are keen to chat further about various strategies you can apply for your next property purchase, just give us a buzz. It’s free consultation, and let’s just chat property.

* This is general information only and should not be taken as a financial advice. Please consult your financial experts and accountant. Easy Buyer’s Agent does not and cannot guarantee the performance of any of the properties we buy as it is all market driven.

#investing #propertyinvestment #property #realestate #propertyinvesting #buyersagent