![]()

![]()

![]() PERTH’S LIVING MONTHLY BUDGET. Can you afford buying a #property using average #Salary? The average salary here in Perth as a single person is about $85,000 which brings in (according to PayCalculator) about $5579/month net. #buyersagent

PERTH’S LIVING MONTHLY BUDGET. Can you afford buying a #property using average #Salary? The average salary here in Perth as a single person is about $85,000 which brings in (according to PayCalculator) about $5579/month net. #buyersagent

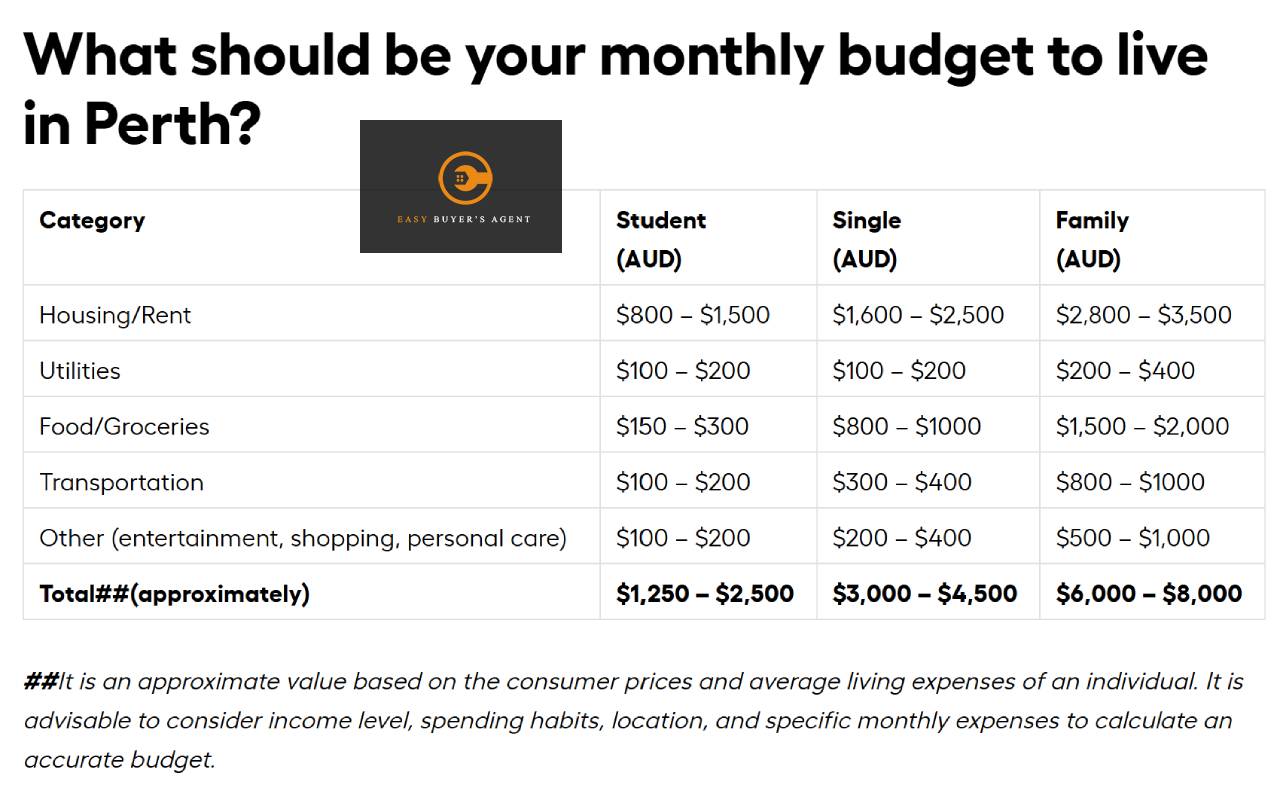

Based on the the table below, even if you are on the highest percentile expense-wise as a single adult, it’s about $4500/month. So, that leaves you with $1579/month. Let’s assume 20% approximation error, that will still leave you with $1263/month spare to go towards investing or saving for a house.

If you invest the $1263/month into an index fund with, say 7%/annual compounding, within 20 years you will have $657,000. If you can contend yourself with living in a modest property albeit a #strata property like #townhouse or #units, even in this market you can still buy them cash. You might argue, “Well, by that time property price will be way more than that”. Sure, but so is your income. Imagine if you’re able to increase your income to $100k or even more, and you are able to contribute more to your investment, that number will go up significantly.

A $2000/month at 7% compounding over 20 years will become $1.047 mil.

While there is a huge outcry at the moment about cost of living crisis, if we take a step back and just look from the bigger picture, buying a property is definitely still a possibility even in this market.

In my view, these are the key things:

– Increase income.

– Keep expense low.

– Don’t try to keep up with the Joneses. Don’t believe social media. Going to Instagram and looking at these people flexing their Lambo and holidays will only make you sad. The truth is, most of them are buying these stuff on loan anyway.

– Don’t spend more than you make. Try saving 20% of your income every month and only live on the 80%. “Pay yourself first” is the mantra.

– Don’t loan to buy depreciating assets like cars or holidays. Always buy them cash. If you can’t buy them cash, you can’t afford them.

If you are young and single especially, that’s the best time to save as much as you can. Whilst I’m fully debt-free now, had I been more prudent with my money in my early 20s and not wasting them on depreciating assets, I would have had extra $2mil now in the bank.