INCOME-BASED PROPERTY GROWTH

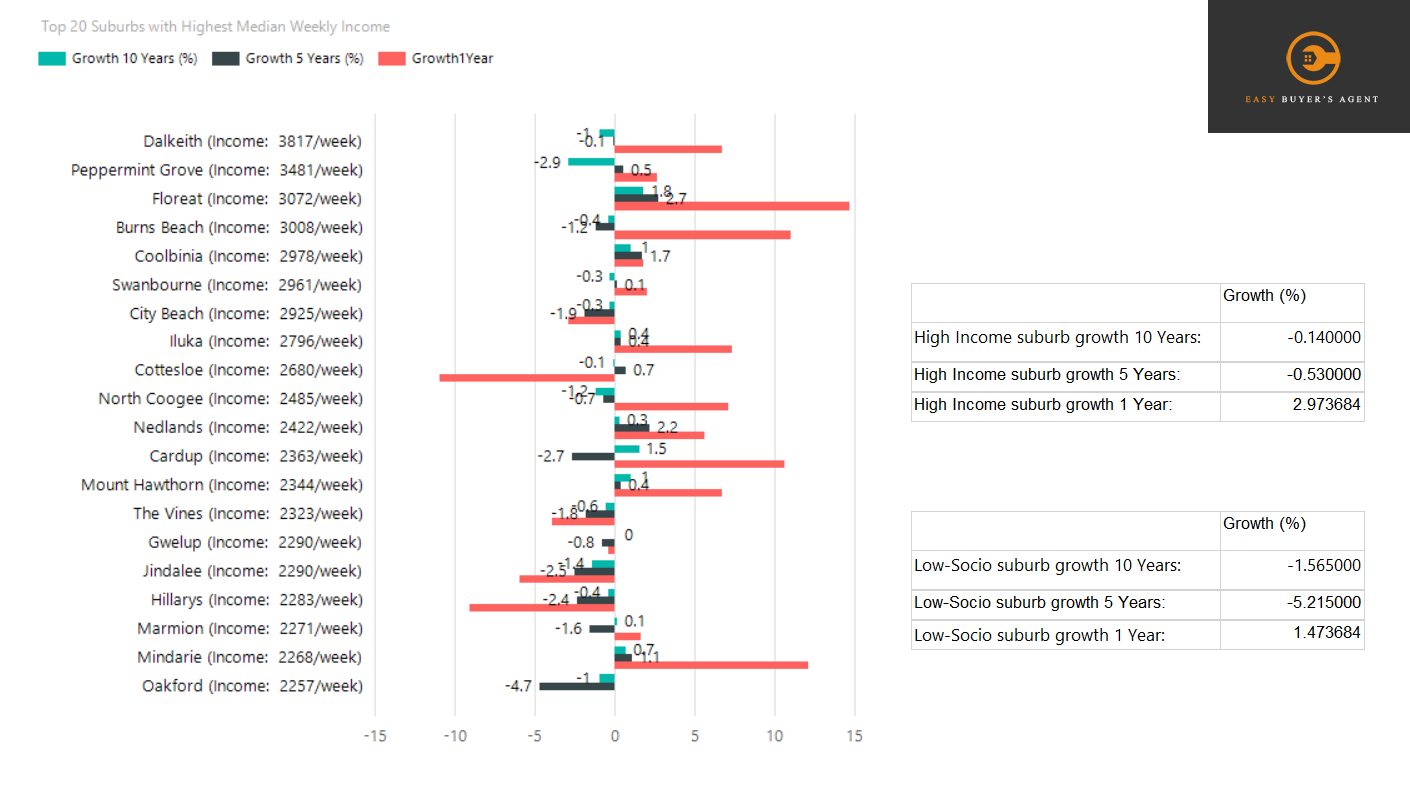

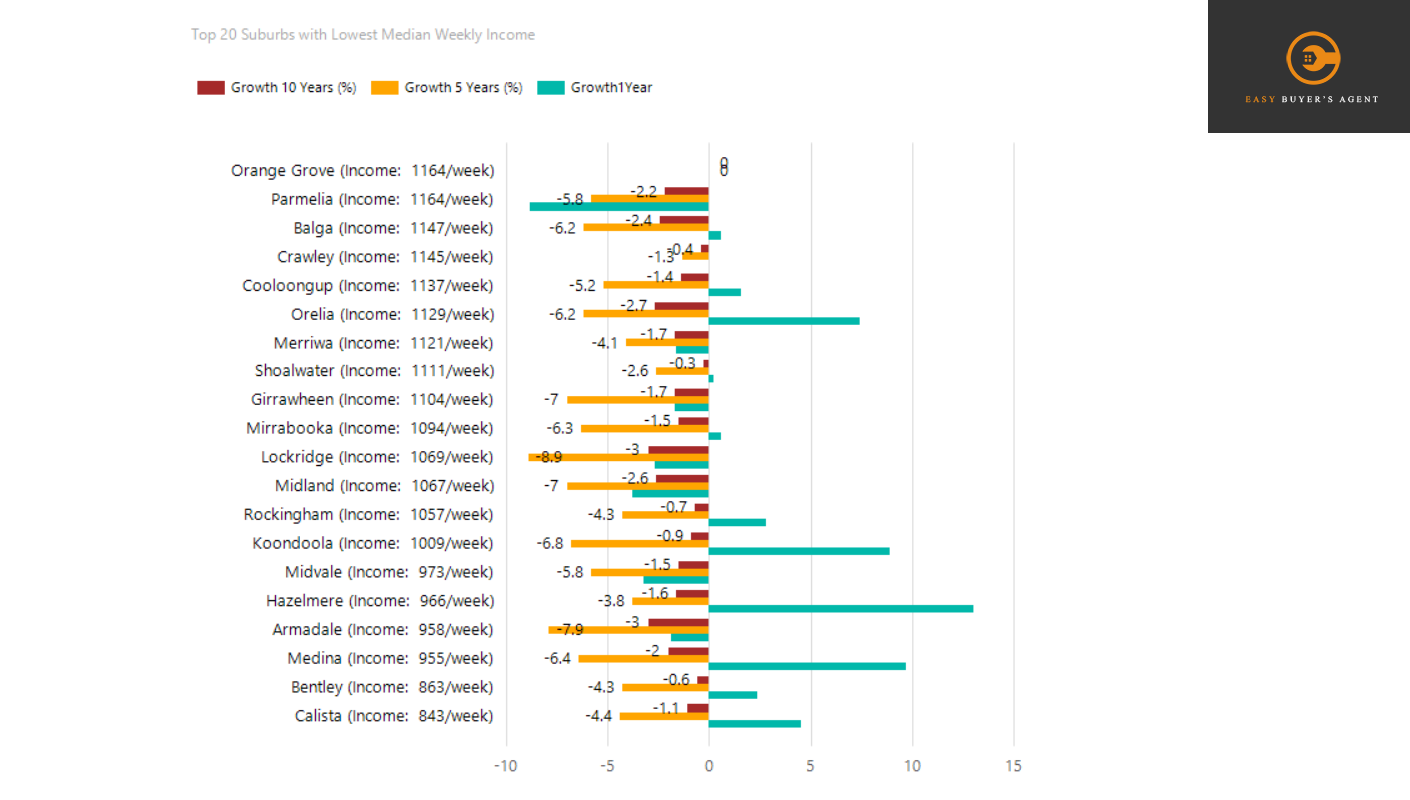

Does income of the population demography of a particular suburb affect its growth rate? Check this out. I took a sample of 20 suburbs with highest median population income VS 20 of the lowest.

* Data refresh was done in October 2020.

When I look at this report, first thing to establish is that Perth has not had capital growth for the past 10 years. It doesn’t matter which suburbs you are looking at, the growth is just not there. When mining went bust, so did the growth and property value.

Let’s look at the drop in price first. The low-incomer suburbs seem to drop more than the high-incomer counterparts. The high-incomers seem to be more stable. As you can see from below, over 10 years, the low-incomers dropped about -1.565% in value compared to -0.14% for the high-incomers.

As for growth, well I can only draw conclusion for the past 1 year only simply because there hasn’t been growth prior (across the board). The number shows that high-incomers grew more over the past year in comparison to the low-incomers. However, I do believe that what this actually means is: the high-incomers grow first and not more than the low-incomers.

From the graph below, some of the low-incomers have also grown, and I believe more will follow.

So…what does this tell me? My conclusion goes as follows:

– Blue-chip suburbs are more stable. However, the holding cost is way more expensive. There is NO WAY will you be able to get positive gearing/cashflow out of these suburbs if you have to borrow 80%+ from the bank. The rental income is nothing compared to the running costs.

– Low-Medium suburbs are more prone to price fluctuation. However, holding cost is way less. Getting positive gearing properties are possible in these areas. Growth still happens to these suburbs which rate can also be as high if not, higher than the high-incomers counterparts.

Depending on what strategies you want to execute, high-incomers are good for renovation and build projects simply because the selling price is higher. Or if you have a lot of cash and does not need to borrow much from the bank, holding onto blue-chip suburbs are also good.

I know a lot of people say, “Well Tommy, the growth you get from the blue-chip will overshadow any running costs and negative gearing”. My answer to that is, “Sure…but if I have $1mil to invest, instead of buying 1 x $1mil, I might get way better returns by buying 5 x $200k”.

Finally, low-medium suburbs are generally good for buy-hold and renovation strategies. For building new, unless you are doing it for owner-occupying, generally it does not show as good returns simply because the selling price is low.

What’s your thought on this? Where would you buy? Let’s chat property.

#investing #propertyinvestment #property #realestate #propertyinvesting #buyersagent