Is There Such Thing Called A-Grade Properties?

I heard so many times about this thing called “A-Grade vs B-Grade” properties. Basically, the premise is centered around, it is better to buy one A-Grade property compared to multiple B-Grade properties. What they often refer to is on the capital growth of these properties.Â

To achieve capital growth, three things matter: location, location, location. Basically, capital growth is determined by demand. When there is more demand than supply, price increase. And, an A-Grade property, that is often positioned in a very prime location, often attracts huge demands, thus, capital growth.

So, I decide to prove it on my own. I really want to be very scientific. There is no point of just talking opinions without actually seeing its results. If people are really concerned about buying an A-Grade property, I really want to compare its capital growth performance with the B-Grade properties.

Below is the exercise:

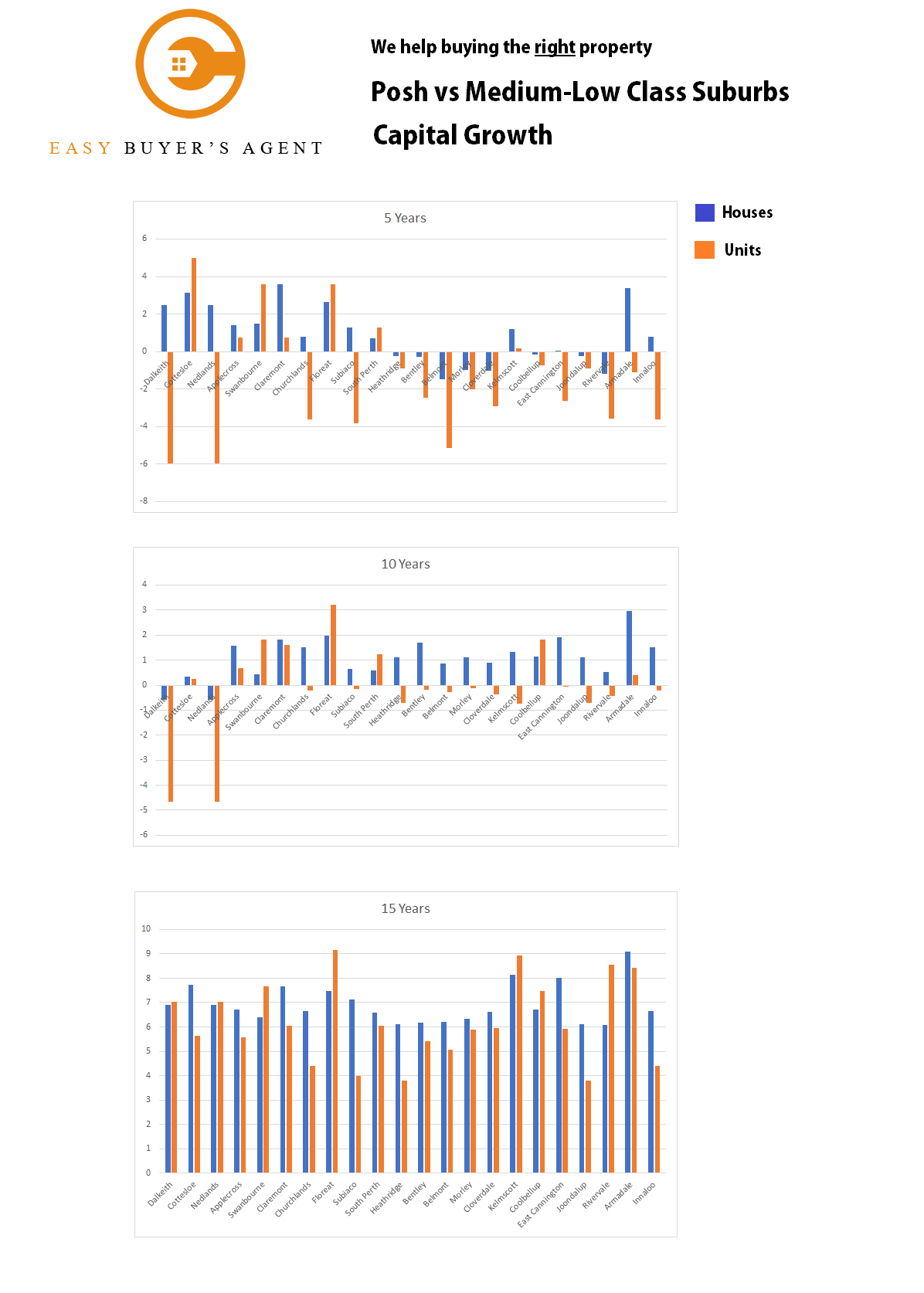

- I took a sample of houses and units from 10 Posh suburbs (which are often the A-Grade properties are located eg. near water, near CBD, etc)

- Then I took a sample of houses and units from ~12 Medium-Low class suburbs (the ones so-called B-Grade due to its location, distance from CBD, demographic of the population, income, etc)

- I then compare its capital growth percentage within 5, 10, 15 yearsÂ

Below are my findings:

Easy Buyer’s Agent Analysis

The first 10 suburbs from the left are Posh ones. The rest are Medium-Low.

Posh suburbs price range are in the 800k+, less than 10km from CBD, near water.

The Medium-Low ones are in the $500k and below, and can be up to 40km from CBD. They are not close to the water and are populated with medium-class workers.

If you look at the 5-Year growth, it is suffice to say that Posh suburbs have more growth than the Medium-Low ones. With 10-Years and 15-Years however, the Medium-Low definitely show similar growth! This is really-really interesting!

As for me, I personally have debunked the myth! If you can hold the property for 10+ years, then you’re actually experiencing similar growth regardless of suburbs! This is why, by looking at these facts, I’m no longer bothered with A-Grade or B-Grade. Basically, if I can purchase the right one and can hold onto it for a long time, I will always win!

A-Grade properties are so expensive! These are often the money-bleeding ones. If you buy as an Owner-Occupier then it’s a different story since you would enjoy the location and lifestyle. However, if you purchase it as an investment, be prepared to bleed lots and lots of money unless you are able to fully pay it off, or at least have a chunk of the mortgage paid off.Â

As for me, I would buy multiple B-Grade properties as an investment. Not only are they cheap, with current low interest rate I can definitely get positive cashflow, or even positive gearing which will allow me to hold onto them for 10+ years.

So, from our observation, the B-Grade properties still double in value long term. The $100,000 property will become $200,000. And so will the $1,000,000 ones. The difference is in the holding cost! If you have one $1,000,000 property and it gives you so much mortgage stress, then what’s the point? As for me, I would rather own few of the B-Grade ones but positive cashflowed. That way, I don’t bleed any money and I can enjoy my life more!

To close this off, if you haven’t read, we have purchased some positive gearing properties. Yep, you read it right. Not only is it positive cashflow, we can actually find positive gearing ones! Click here for more info.

Thanks for reading!