The Property Clock – What is it? And What Do You Need to Know?

Have you heard the saying, “In Australia, property prices double in value in every 8-10 years”? While the statement might be true if you look at the property market holistically for the past 30+ years, in reality, every year, property prices are going up-and-down based on economy cycle. Put it this way, some years your property will grow by 1-2%, some will be -10%, some will be +30%. But on average (over 30 years+), they should grow by 8-10%. I hope this makes sense?

Unlike putting money in the bank which it is guaranteed to grow annually by whatever interest rate they’re giving for that particular year, with properties, you have to look at it from a long-term point of view. If you look at it year-by-year only, it would go up and down depending on the market condition.

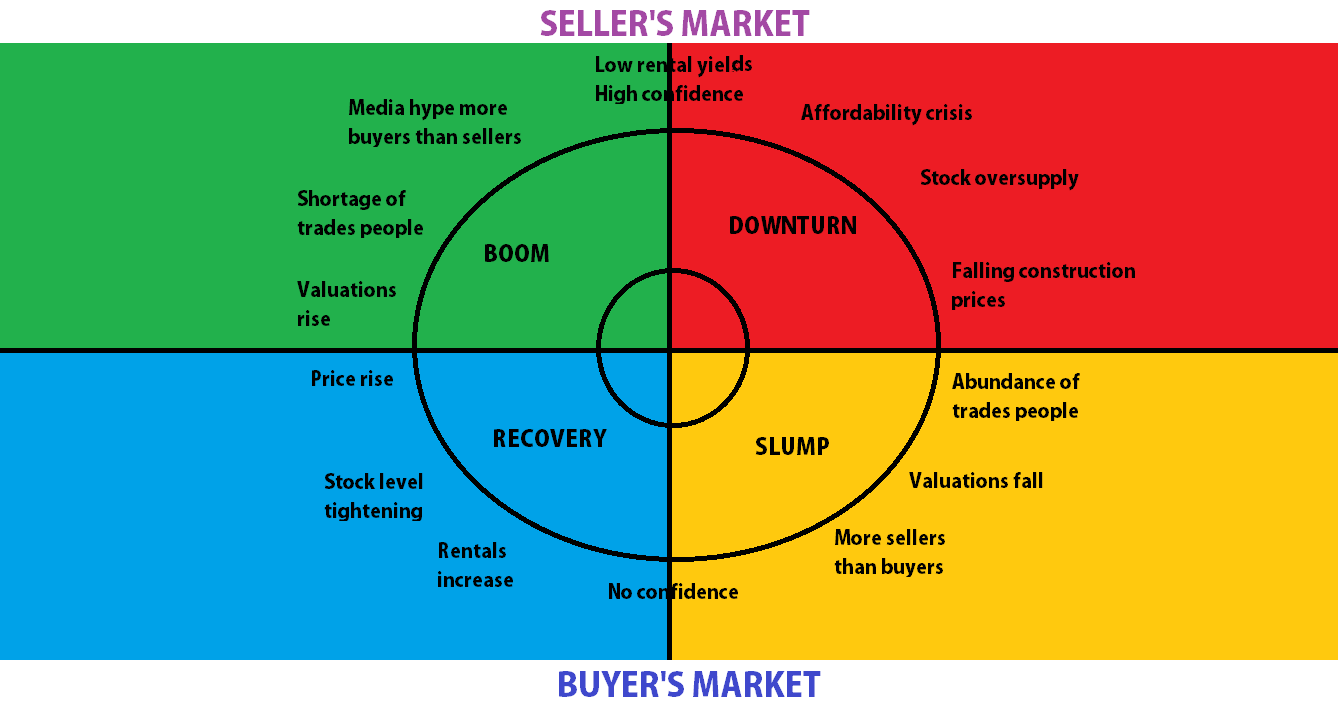

This market condition is what I call “The Property Clock”. My mother used to say, life is like a wheel. Sometimes you’re at the top, sometimes you’re at the bottom. And market condition is exactly like that. Sometimes it’s at the top, sometimes it’s at the bottom. Sometimes jobs are really growing, government decides to put in a lot of resources to build the city/country, other countries decide to import a lot of resources from Australia, etc. Thus, creating a lot of demands for properties ie. price increase.

However, at some point, all development needs to finish. Governments can’t keep building without being able to manage them. When this happens, everything cools off. Jobs are not growing as much. Salary stalls. Some jobs need to even be cut off. People are not earning as much. Thus, putting a lot of downward pressure on property market. Demands are low, banks are tightening, etc. Thus, price decrease.

But, all downturns need to finish also. At some point, as population grows, demands on infrastructure, etc will increase. Thus, pushing governments to start building again. And, there would be more businesses open, more start-ups, etc. The cycle then starts again.

Even though market goes up and down, one thing that always happens for sure is: prices will always go up. And it will never go back to what it was 20-30 years ago. Think about it, my dad used to buy Toyota Corolla for $2,000. Now it would cost you at least $15,000. Same with property, prices will never go back to what it was in 1970.

So, being able to identify these events in the cycle is very important. We need to know when we need to buy and we need to sell. Or, if you are like me who decide to hold onto properties for a long time, being able to determine where we are in the “clock” will help me putting strategies around my investments so that I’m weathered from the storm.

Let’s look at the clock below:

We’ve put down the events that generally happen on each hour of the clock. This will be able to help us in determining when to buy or when to sell. Why is this important? Because we want to buy low and sell high. When we don’t buy at the right time, we might be paying too much. If I’m a buyer during Seller’s Market for example, sellers won’t budge with their prices. It would be harder for me to negotiate. And vice versa. If I’m a seller during Buyer’s Market, it would be really hard for me to get a good price on my sale.

And not just that, if you don’t know when storms are coming and you don’t put strategies around you, you might get caught and be in financial stress. During downturns, everything slows down: jobs, market, economy etc. People who used to earn so much money and being able to sell their products and services like peanuts, are no longer able to do the same during a downturn. Thus, they might have to let go some of their employees. Now, their employees’s confidence are low. People who used to be able to afford drinking coffee once a day, now they can only afford once a week. This brings pressure to local retailers, etc etc etc. Do you see the snowball effect? And this would certainly affect you as a property owner.

Being able to identify the events in the clock would help us putting strategies around them. Maybe we can look at refinance at the top of the clock so that those extra cash can help us weather the storm for years to come? Or maybe we can decide to sell some of our properties and decide to keep cash? Whatever the strategy may be, what I’m saying is, this Property Clock is very-very important to be recognised.